Your cart is currently empty!

Role of a Purchase Order PO in the Procurement Cycle in Thailand

The balance sheet is a depiction of the financial position of the business entity. It displays the assets owned by the entity, liabilities owed to creditors, and owner’s capital/equity at the date of hire accountants its preparation. The accounting cycle helps produce helpful information for external users, such as stakeholders and investors, while the budget cycle is used specifically for internal management.

- After posting is complete, we will be able to see all increases and decreases in Cash; and from that, we can determine the remaining balance.

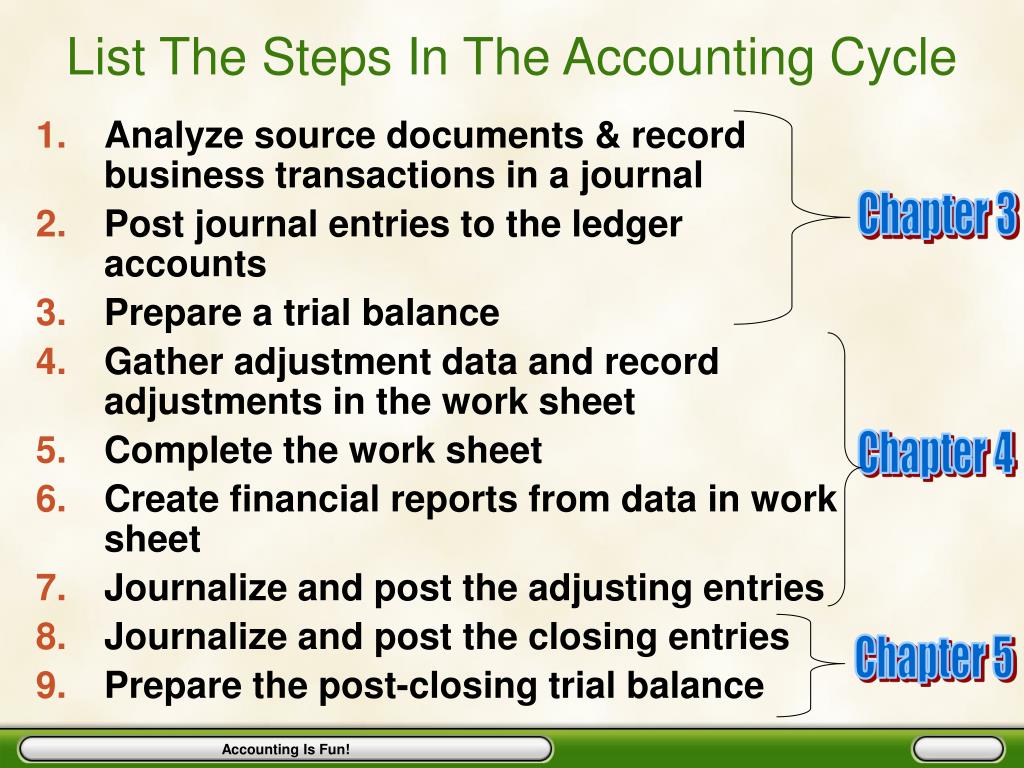

- The accounting cycle consists of the steps from recording business transactions to generating financial statements for an accounting period.

- Some companies prepare financial statements on a quarterly basis whereas other companies prepare them annually.

- After determining the accounts involved, the next step is to journalize the transaction in a journal book.

Accounting cycle time period

A journal is a book – paper or electronic – wherein transactions are recorded. Also, this step would involve the preparation or collection of business documents, or as auditors would call them – source documents. A business document (such as sales invoice, official receipt, etc.) provides evidence that a particular transaction happened, and serves as basis in recording the transaction. Business transactions identified are then analyzed to determine the accounts affected and the amounts to be recorded.

Role of a Purchase Order (PO) in the Procurement Cycle in Thailand

After closing temporary accounts and updating the Retained Earnings account, the next step is preparing a post-closing trial balance. It serves as a checkpoint to verify that the debits and credits still balance after the closing process. A trial balance is a crucial step in the accounting cycle, as it comprises a list of all general ledger accounts with nonzero balances. To prepare an unadjusted trial balance, accountants collect data at the end of a reporting period as the fourth step in the accounting cycle. Once the entries are recorded in the journal, they are transferred to the general ledger.

Preparing a Trail Balance

If these errors aren’t caught and corrected, they can give you and your employees an inaccurate view of your company’s financial situation. The eight-step accounting cycle starts with recording every company transaction individually and ends with a comprehensive report of the company’s activities for the designated cycle timeframe. Many companies use accounting software or other technology to automate the accounting cycle.

Accountants first need to gather information about business transactions, then record and collate them to come up with values to be reported (steps 1-6 in the accounting cycle). Financial information is ultimately presented in reports called financial statements (step 7). The accounting cycle, also commonly referred to as accounting process, is a series of procedures in the collection, processing, and communication of financial information. It involves specific steps in recording, classifying, summarizing, and interpreting transactions and events of a business entity. During the accounting cycle, many transactions occur and are recorded. At the end of the fiscal year, financial statements are prepared (and are often required by government regulation).

Ready to save time and money?

At the end of the accounting period, a trial balance is calculated as the fourth step in the accounting cycle. A trial balance shows the company its unadjusted balances in each account. The unadjusted trial balance is then carried forward to the fifth step for testing and analysis. With double-entry accounting, common in business-to-business transactions, each transaction has a debit and a credit equal to each other. The accounting cycle incorporates all the accounts, journal entries, T accounts, debits, and credits, adjusting entries over a full cycle.

Mapping out plans and dates that coincide with your accounting deadlines will increase productivity and results. Completing the accounting cycle can be time-consuming, especially if you don’t feel organized. Here are some tips to help streamline the bookkeeping process and save you time. What’s left at the end of the process is called a post-closing trial balance.

They are recorded in journal entries under at least two accounts (at least one debited and at least one credited). HighRadius Autonomous Accounting Application consists of End-to-end Financial Close Automation, AI-powered Anomaly Detection and Account Reconciliation, and Connected Workspaces. Delivered as SaaS, our solutions seamlessly integrate bi-directionally with multiple systems including ERPs, HR, CRM, Payroll, and banks. A business’s accounting period is determined by various factors, including reporting obligations and deadlines. The accounting period refers to the timeframe for preparing financial documents, varying from monthly to annually. Companies may opt for monthly, quarterly, or annual financial analyses based on their specific needs.

Αφήστε μια απάντηση