Your cart is currently empty!

Accounting Cycle Simplified: A Step-by-Step Guide for Businesses

Transactions are financial events involving the exchange of value, such as sales, purchases, and vendor payments. These transactions impact the business’s financial statements, including the balance sheet, income statement, and cash flow statement. After preparing the income statement (or profit and loss account) and balance sheet, all temporary or nominal accounts used during the financial period are closed. This is done by means of specific journal entries known as closing entries.

Are bookkeeping and accounting different?

In conclusion, preparing final statements is a crucial step in the accounting cycle, as it informs decision-makers about the financial performance and position of a company. It is crucial to maintain proper documentation supporting each transaction. This may include invoices, receipts, contracts, and any correspondence related to the transaction. Proper documentation not only facilitates the preparation of accurate financial statements but also aids in the audit process and compliance with regulatory requirements.

Using financial insights to maximize your business potential

- You need to calculate the trial balance at the end of the fiscal year.

- After the unadjusted trial balance has been calculated, the worksheet can be analyzed.

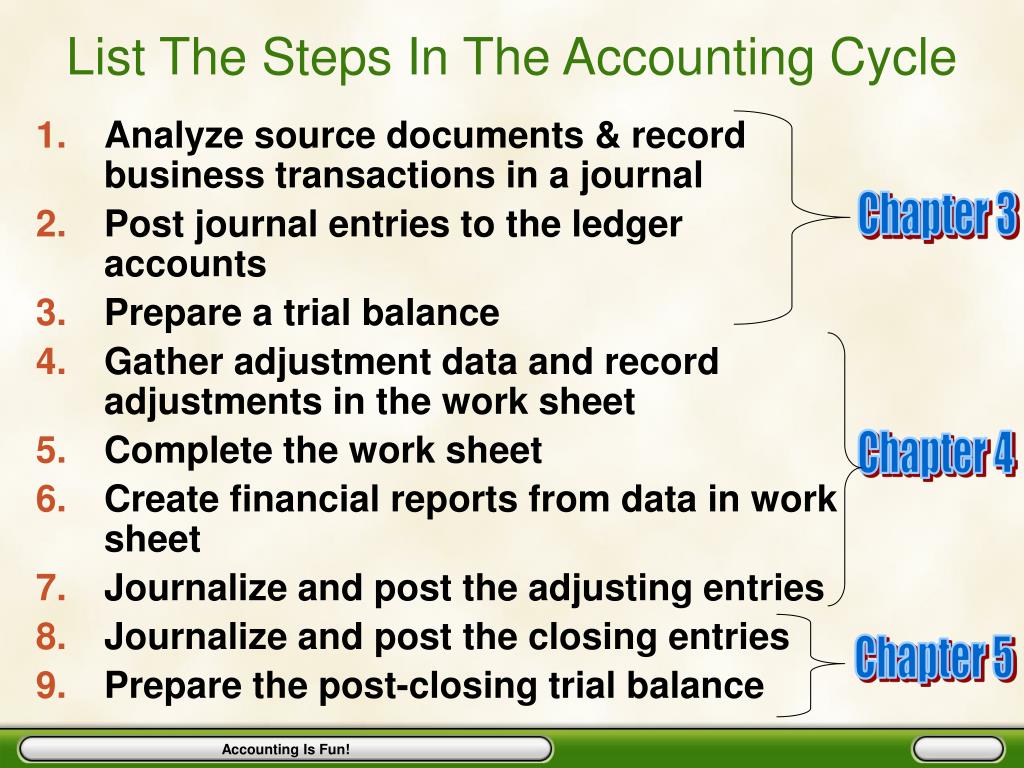

- Following the accounting cycle is a standard practice that helps to ensure that all financial transactions are accounted for.

- She is a highly motivated and detail-oriented individual with a passion for learning.

- With this collective information at hand, accountants can then prepare financial statements and produce reports, making the posting process essential to the accounting cycle.

Learn how to build, read, and use financial statements for your business so you can make more informed decisions. Some disadvantages are that the information may be biased, can be estimated to a degree, can be manipulated, and that the units used to measure business performance, namely cash, change in value. When a department in the company needs to purchase any item, they fill out a purchase requisition and specify the item’s type, price, and purpose of use. The purchase requisition needs to be approved by an authorized personnel before proceeding with the purchase to ensure that the item is truly beneficial and necessary for the company. A purchase order (PO) is an extension of a purchase requisition (PR).

Post Journal Entries to General Ledger

This can impact a business’s financial statements and financial position. If financial activity goes unidentified, it cannot be reviewed or monitored by the business. Companies can modify the accounting cycle’s steps to fit their business models and accounting procedures. One of the major modifications you can make is the type of accounting method used.

Financial Close Solution Advantages

For example, if a business sells $25,000 worth of product over the year, the sales revenue ledger will have a $25,000 credit in it. This credit needs increase manufacturing capacity in times of crisis with lean principles to be offset with a $25,000 debit to make the balance zero. A balance sheet can then be prepared, made up of assets, liabilities, and owner’s equity.

Barbara has an MBA from The University of Texas and an active CPA license. When she’s not writing, Barbara likes to research public companies and play Pickleball, Texas Hold ‘em poker, bridge, and Mah Jongg. In this case, the inventory account is debited, increasing the asset account. Simultaneously, accounts payable, a liability account, is credited, reflecting the increase in a liability.

Once you close the accounts, you’re ready to restart the accounting cycle for the next fiscal year. After a stint in equity research, he switched to writing for B2B brands full-time. Arjun has since written for investment firms, consultants, and SaaS brands in the Accounting and Finance space. Whether your accounting period is monthly, quarterly, or annually, timing is crucial to implementing the accounting cycle properly.

After financial statements are published and released to the public, the company can close its books for the period. Closing entries are made and posted to the post closing trial balance. When a transaction is recorded, it has to be posted to an account on the general ledger.

Our intuitive software automates the busywork with powerful tools and features designed to help you simplify your financial management and make informed business decisions. Bench simplifies your small business accounting by combining intuitive software that automates the busywork with real, professional human support. Once the supplier collects the cheque at the finance department, they sign on a cheque register and provide receipts as evidence of payment. The finance department then stamps the documents with a ‘Paid’ designation to prevent duplicate payments before returning them to accounting for record-keeping.

Αφήστε μια απάντηση