Your cart is currently empty!

401k limit increases to $23,500 for 2025, IRA limit remains $7,000 Internal Revenue Service

This means that $15 is the remaining profit that you can use to cover the fixed cost of manufacturing umbrellas. Also, you can use the contribution per unit formula to determine the selling price of each umbrella. That is, fixed costs remain unaffected even if there is no production during a particular period. Fixed costs are used in the break even analysis to determine the price and the level of production.

Contribution Margin by Product

- This $60 represents your product’s contribution to covering your fixed costs (rent, salaries, utilities) and generating a profit.

- These costs may be higher because technology is often more expensive when it is new than it will be in the future, when it is easier and more cost effective to produce and also more accessible.

- The first step to calculate the contribution margin is to determine the net sales of your business.

- While there are plenty of profitability metrics—ranging from the gross margin down to the net profit margin—the contribution margin metric stands out for the analysis of a specific product or service.

- In Cost-Volume-Profit Analysis, where it simplifies calculation of net income and, especially, break-even analysis.

To illustrate how this form of income statement can be used, contribution margin income statements for Hicks Manufacturing are shown for the months of April and May. Mastering these financial concepts is essential for today’s self assessment income and expense tracker spreadsheet business leaders. These tools help managers navigate the complexities of modern business, driving sales, profitability and sustainable growth. Now, divide the total contribution margin by the number of units sold.

How to improve contribution margin

Direct Costs are the costs that can be directly identified or allocated to your products. For instance, direct material cost and direct labor cost are the costs that can be directly allocated with producing your goods. Furthermore, an increase in the contribution margin increases the amount of profit as well. Furthermore, it also gives you an understanding of the amount of profit you can generate after covering your fixed cost. Such an analysis would help you to undertake better decisions regarding where and how to sell your products. The following formula shows how to calculate contribution margin ratio.

Contribution Margin: What Is It and How To Calculate It

After you’ve completed the unit contribution margin calculation, you can also determine the contribution margin by product in total dollars. A subcategory of fixed costs is overhead costs that are allocated in GAAP accounting to inventory and cost of goods sold. This allocation of fixed overhead isn’t done for internal analysis of contribution margin.

Contribution Margin Formula Components

If they send nine to sixteen students, the fixed cost would be \(\$400\) because they will need two vans. We would consider the relevant range to be between one and eight passengers, and the fixed cost in this range would be \(\$200\). If they exceed the initial relevant range, the fixed costs would increase to \(\$400\) for nine to sixteen passengers. This is because the breakeven point indicates whether your company can cover its fixed cost without any additional funding from outside financiers.

This, in turn, can help people make better decisions regarding product & service pricing, product lines, and sales commissions or bonuses. While there are plenty of profitability metrics—ranging from the gross margin down to the net profit margin—the contribution margin metric stands out for the analysis of a specific product or service. The Contribution Margin is the incremental profit earned on each unit of product sold, calculated by subtracting direct variable costs from revenue. The contribution margin is important because it gives you a clear, quick picture of how much “bang for your buck” you’re getting on each sale.

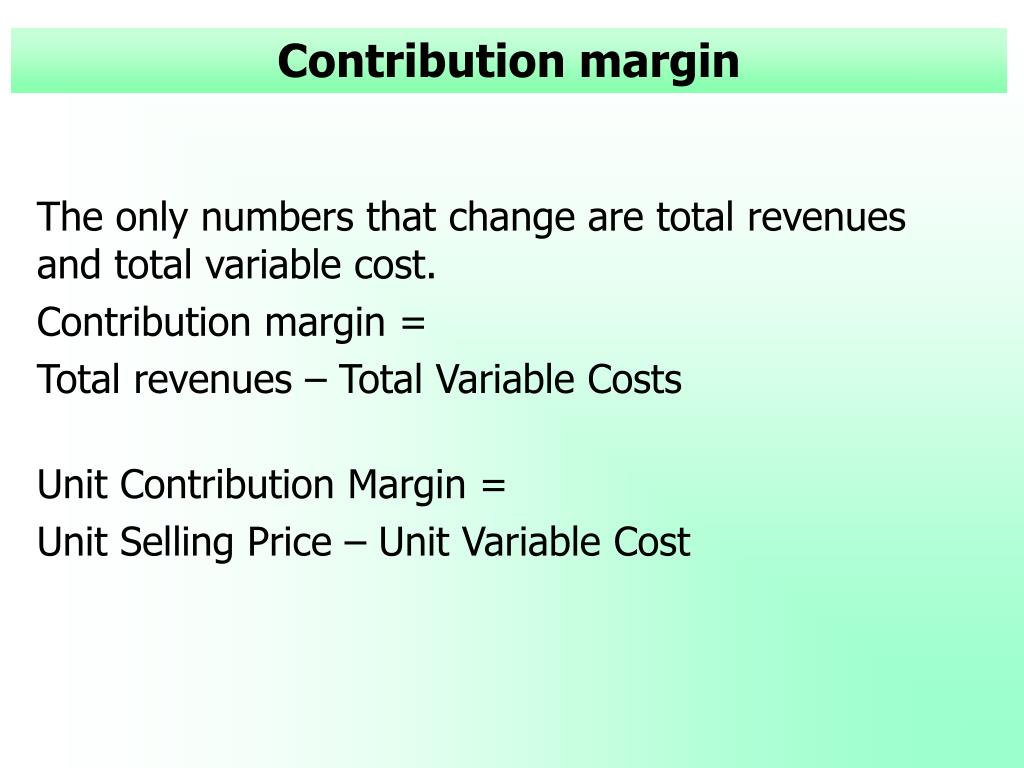

The contribution margin is computed as the selling price per unit, minus the variable cost per unit. Also known as dollar contribution per unit, the measure indicates how a particular product contributes to the overall profit of the company. Recall that Building Blocks of Managerial Accounting explained the characteristics of fixed and variable costs and introduced the basics of cost behavior. Let’s now apply these behaviors to the concept of contribution margin. The company will use this “margin” to cover fixed expenses and hopefully to provide a profit. Typical variable costs include direct material costs, production labor costs, shipping supplies, and sales commissions.

Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

A high contribution margin indicates that a company tends to bring in more money than it spends. The contribution margin can help company management select from among several possible products that compete to use the same set of manufacturing resources. Say that a company has a pen-manufacturing machine that is capable of producing both ink pens and ball-point pens, and management must make a choice to produce only one of them.

Calculate contribution margin for the overall business, for each product, and as a contribution margin ratio. Calculations with given assumptions follow in the Examples of Contribution Margin section. More importantly, your company’s contribution margin can tell you how much profit potential a product has after accounting for specific costs. Investors examine contribution margins to determine if a company is using its revenue effectively.

Αφήστε μια απάντηση