Your cart is currently empty!

Contribution Margin Ratio Formula Per Unit Example Calculation

Some examples include raw materials, delivery costs, hourly labor costs and commissions. If a company has $2 million in revenue and its COGS is $1.5 million, gross margin would equal revenue minus COGS, which is $500,000 or ($2 million – $1.5 million). As a percentage, the company’s gross profit margin is 25%, or ($2 million – $1.5 million) / $2 million.

Contribution Margin by Product

- That is it does not include any deductions like sales return and allowances.

- Since machine and software costs are often depreciated or amortized, these costs tend to be the same or fixed, no matter the level of activity within a given relevant range.

- Contribution margin is the remaining earnings that have not been taken up by variable costs and that can be used to cover fixed costs.

- On the other hand, net sales revenue refers to the total receipts from the sale of goods and services after deducting sales return and allowances.

- Profits will equal the number of units sold in excess of 3,000 units multiplied by the unit contribution margin.

Perhaps even more usefully, they can be drawn up for each product line or service. Here’s an example, showing a breakdown of Beta’s three main product lines. For example, raising prices increases contribution margin in the short term, but it could also lead to lower sales volume in the long run if buyers are unhappy about it. Before making any changes to your pricing or production processes, weigh the potential costs and benefits. In the same example, CMR per unit is $100-$40/$100, which is equal to 0.60 or 60%.

Is a high contribution margin ratio good?

Put more simply, a contribution margin tells you how much money every extra sale contributes to your total profits after hitting a specific profitability point. Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site.

Contribution Margin for Overall Business in Dollars

For professionals looking to enhance their financial acumen and advance their careers, Florida Tech’s online MBA program offers comprehensive training in these critical areas. By developing expertise in these financial techniques, graduates emerge well equipped to tackle the strategic challenges of modern business. You work it out by dividing your contribution margin by the number of hours worked. Accordingly, the net sales of Dobson Books Company during the previous year was $200,000.

What is contribution margin?

By focusing on contribution margin, managers can quickly assess which products truly drive profitability. This insight is invaluable for making decisions about product mix, pricing strategies and resource allocation. For example, a product with a high contribution margin might be worth promoting more aggressively, even if its overall profit margin seems lower initially. To master cost-behavior analysis, business leaders employ a variety of techniques. They immerse themselves in historical data, searching for patterns that reveal how costs have responded to activity changes in the past. Some use statistical tools like regression analysis to quantify these relationships more precisely.

Take your learning and productivity to the next level with our Premium Templates.

The contribution margin per hour of OR time is the hospital revenue generated by a surgical case, less all the hospitalization variable labor and supply costs. Variable costs, such as implants, vary directly with the volume of cases performed. Reduce variable costs by getting better deals on raw materials, packaging, and shipping, finding cheaper materials or alternatives, or reducing labor costs and time by improving efficiency.

Gross margin is commonly used as an aggregate measurement of a company’s overall profitability. The contribution margin is used by internal management to gauge the variable costs of producing each product. This means that the production of grapple grommets produce enough revenue to cover the fixed costs and still leave Casey with a profit of $45,000 at the end of the year.

This is because it indicates the rate of profitability of your business. The gross sales revenue refers to the total amount your business cost volume profit formula realizes from the sale of goods or services. That is it does not include any deductions like sales return and allowances.

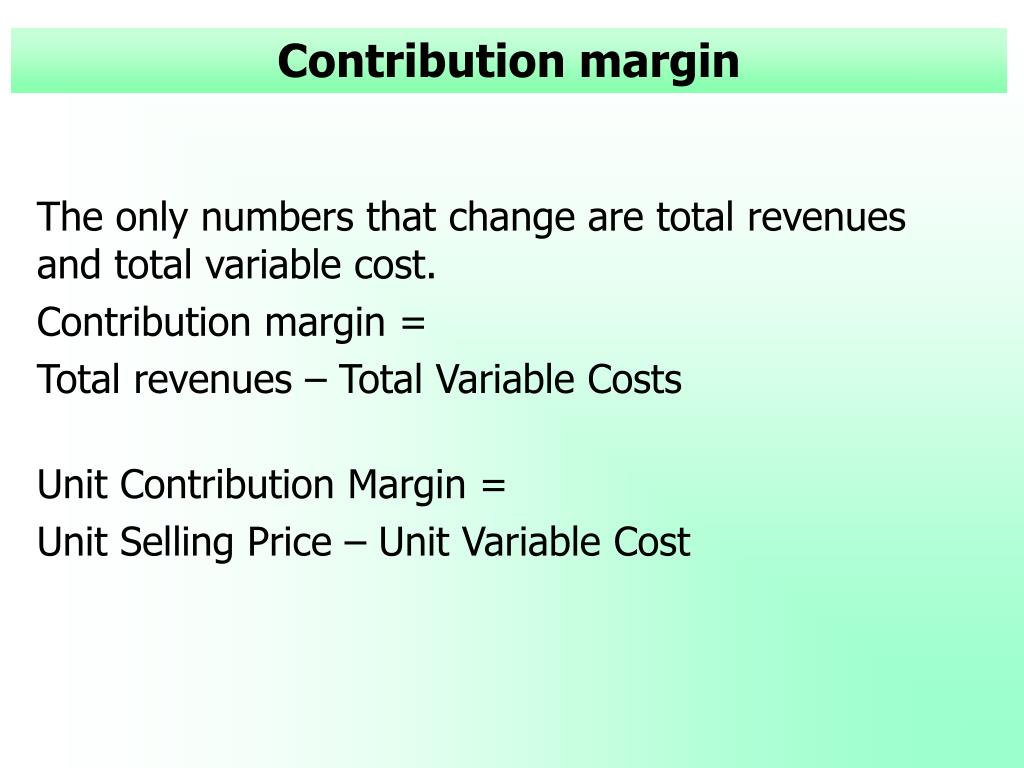

All of these new trends result in changes in the composition of fixed and variable costs for a company and it is this composition that helps determine a company’s profit. Once you have calculated the total variable cost, the next step is to calculate the contribution margin. The contribution margin is the difference between total sales revenue and the variable cost of producing a given level of output. In other words, contribution margin per unit is the amount of money that each unit of your product generates to pay for the fixed cost.

The contribution margin can be presented in dollars or as a percentage. A firm’s ability to make profits is also revealed by the P/V ratio. With a high contribution margin ratio, a firm makes greater profits when sales increase and more losses when sales decrease compared to a firm with a low ratio.

Αφήστε μια απάντηση